Living with Money

There is more than money connected to the financial part of your life. Your mindset for money affects or is affected by how you maintain every aspect of your life.

There is more than one aspect to track. Track your money activity, yes; but, also, remember to track your emotions, your health, your spiritual condition, and your education that leads to better skills and opportunities. A journal might help you to track those.

Simple Effort

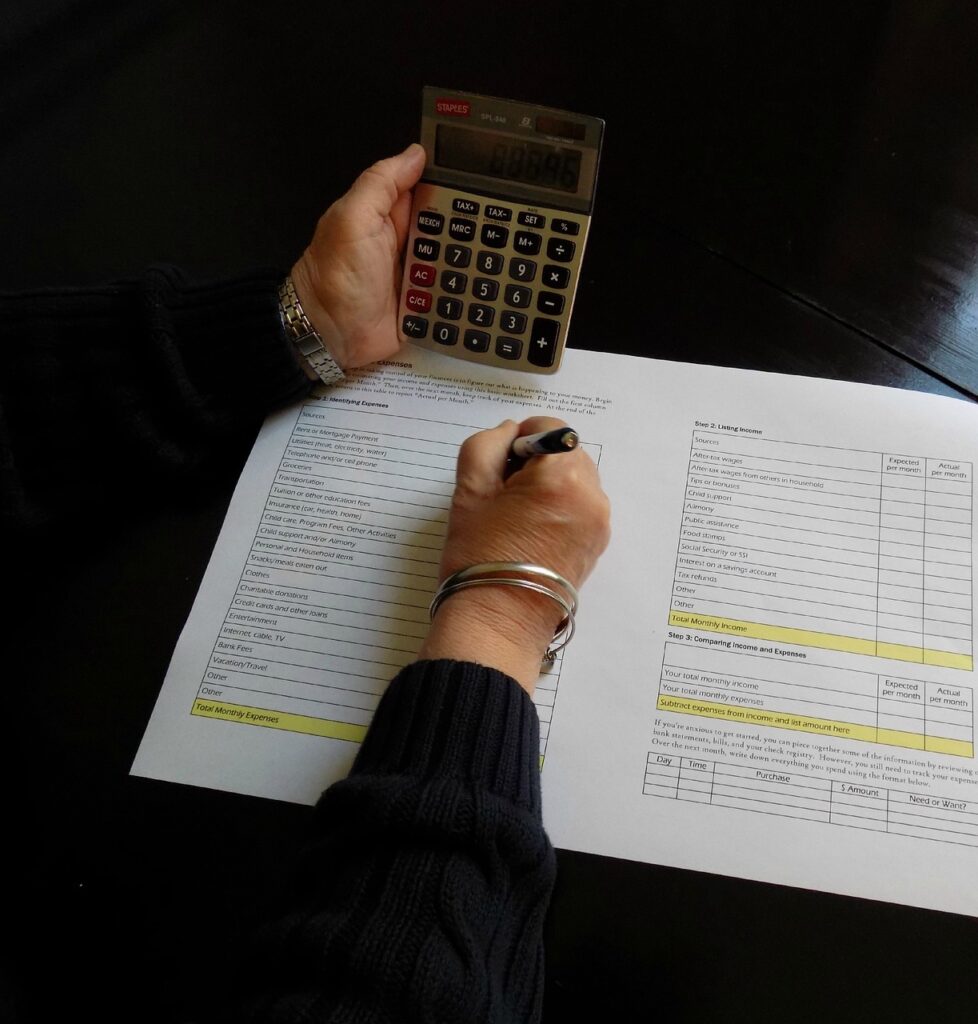

It is so important to make the simple effort to look at your money matters in detail to build a better mindset for money.

A budget is comprised of simple line items, the reasons for your spending. As you spend your money, at least over a short period of time, keep your receipts. Summarize them by budget line categories. You can use the category “Miscellaneous” if it is a small number. The big numbers need your attention.

Know Why or Where It Goes

The bigger numbers will fall under the categories of groceries, eating out, fuel, and housing.

Review your receipts. Are they for regular expenses? Were there any impulse buys (Do NOT lie to yourself)? And can you make any changes to reduce your spending?

If you worked on a budget to control your spending, how did it work? Did you think of all the categories of your spending pattern? There will be some surprises. Make any needed changes to have an effective budget.

An Income Problem

When your income fails to meet your most basic spending needs, then, you have an income problem.

If you run out of money before your next paycheck, is that an income problem? Not necessarily. Be sure to review your spending carefully before blaming income for the short fall.

Learning to live within your means is the trademark of a better mindset for money.

Tracking Options

In this world of technological advances and instant answers, I know using paper and a pencil is a hard sell. However, from a time management perspective, the TV commercials over an evening allow plenty of time for adding receipts or posting them to an Excel spreadsheet.

There are options for software on your phone. Some entry requirements. That is a “post-as-you-go” process.

Read other blogs. Read some books about tracking your money. You will find a method that appeals to you. Then, use it!

Use the Information

Information is important. That information will give you the tools to structure a better plan, learn from your mistakes or impatience, and what you need to strive for on income to be able to save and create a better future.

You Have the Power to be the CEO.

Your information has been compiled and accounted for by the Chief Financial Officer. Then, the CEO, Chief Executive Officer, with the help of the budget committee, makes the decisions on how the funds (income) will be spent, next month.

That is how businesses should be run. This is your personal business. Make it work. Make it successful!

Your Philosophy Around Money

Civilization has developed beyond what used to be referred to as “savage”. I recognize that, if you wanted to, you could find a cave along a river, plant your own garden, eat game for meat, and dress in deer hides. Keep in mind though, there is a lot of work to do all of that. Yes, you would not need money, but you might get evicted from that guy’s property. Then, what?

My point is that money was designed to be an exchange for goods and services. Your work (job) is a service to a company that has a product or service to sell, etc. And, since we are stuck with the money system, we should develop a philosophy on how to use it.

Some people have learned how to do very well with it. Others have not bothered to work on a philosophy. They just do enough to get by. They cry the loudest, though, when things go badly.

I would suggest that you try to learn all you can about how to use, make, and keep money. That will help you develop a very useful philosophy around money.

More to Money

Many of our decisions around money have an emotional cause or effect.

Shopaholics are trying to make themselves feel better. Personally, I would feel better and more secure with more money in the bank and less debt to pay off.

Income is important. But jobs can be lost, layoffs occur, or the company may go out of business. Since we identify with our jobs, develop friendships on the job, and learn to depend on that paycheck, we become devastated with any form of interruption.

Helping others always makes us feel better. That could be in the form of helping a friend move, volunteering at Meals on Wheels, or donating to a worthy cause. These are examples of giving to receive something other than money.

Your health is important. Eating well and taking vitamins can be expensive. Many more would do that if they could afford to do it.

Exercise helps you maintain your health. Walking is free. However, some like to go to the gym where others are exercising. That costs money. Some decide it is not worth the effort and sit on the couch playing video games and watching TV until the health problems begin. Then, how will they value exercise?

We like vacations and look forward to retirement and traveling and activities with friends and family. Those things require money. Will you save enough to enjoy them?

Will you be able to help your family? Will you leave your family with nothing but your burial expense?

See, there are a lot of emotions and considerations and decisions to make surrounding your money philosophy. I hope you get prepared for them.

You Make It Work

Back to keeping track. Gather the numbers. Look them over. Accumulate a few months of information. The picture of your money coming and going will get much clearer over time.

You can build a better budget and review it against your actual spending. And you can make positive changes as you understand the why behind your spending.

Those positive changes will include planning for more income, making sacrifices to put money into savings, and being more patient on your spending. You can then plan your spending.

As you build reserves for emergencies and future retirement plans, you can feel in control and enjoy the money you do have to spend, with a purpose!