How Do You Spend Your Income?

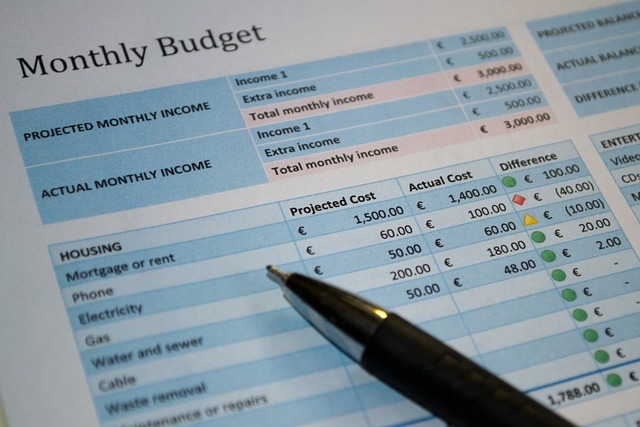

Your budget should have line items for how you spend your income. Okay, for the moment, let us pretend you have a budget. Do you know where your money goes?

I will suggest a few categories for spending that would appear in most budgets:

Savings (Top Priority!)

House payment or Rent

Utilities

Groceries

Eating Out

Fuel

Auto maintenance

Auto Loan

Medical—Health Maintenance (Vitamins, pain meds, etc.)

Health Insurance

Life Insurance

Phone

Cable/Internet

Recreation

Miscellaneous

The fact that you have a budget lets me know that you are trying to build a better mindset for money!

Who Is Fooling Who?

For those who feel they have things under control because they have money at the end of the month, good for you! That’s a start.

Now, you may think you have good controls in place, in your mind, but I believe that the categories of Groceries, Eating Out, and Miscellaneous will add to more than you think. I know they do for me.

That is why you keep receipts and sort by category at the end of a month and add them and compare to your expectations, if you have any. When I found that my grocery total was too high, the reality was that I was including medical supplies and vitamins, which should be a separate category. Even that category will amount to more than you think.

I was an accountant and know that numbers tell a story, especially receipts from your spending. You may find this too tedious for your busy life. Perhaps, you can find an easier way to get the information, like software on your phone, etc. However, I think you will find that getting the information is worth the effort.

As Useful as a Blank Stare

Information like knowing you spent $100 over your grocery budget is useful if you figure out why and if it will continue or was it an unusual event. Your personal business is like a regular business in that it must be managed. That is why companies review the summary numbers and look for trends and how it compares to last year, noting what has changed. That is good management, if they act on the information.

Being able to compare your summary of spending to last month and last year will let you know if you are making progress in your efforts to understand your numbers!

If you collect the information and NEVER review and compare and make mental notes of your spending habits, good or bad, then, those numbers are as useful as a blank stare!

The Easy Answer to Budget Short Falls

The easy answer for running out of money before the end of the month or just spending more than you make is to say, “make more money”.

Although a retail business might go for a sale to get more sales volume, you might have to get a second job.

Or you could try to find ways to cut back on spending!

How Do You Cut Back on Expenses?

Check your pantry. Any duplicates?

How many packages were delivered this week? How many times did you eat out?

Are you keeping a calendar of all this stuff?

Most of us just go with the flow and try to enjoy life. However, occasionally, we need to stop and think about what we are doing and when we are doing it. And, hopefully, you keep the credit card balance low enough to pay it off quickly.

Plan for the Expected and Unexpected

If you use a budget, it should provide for the periodic expenses. That is, your regularly putting money into savings to pull out for the quarterly insurance bill, the oil change due next month, or the realization that the brakes must be replaced before you have an accident.

Some expenses can be planned for. If you have a vehicle, you must expect repairs of some sort, at least, quarterly. Estimate an amount to set aside. I always refer to a trip to the auto shop as “the $500 bill!”

What about the rest of your equipment? You may have a lawn mower, a weed eater, an air conditioner, a furnace, a computer, a dishwasher, etc. You cannot expect them to run forever without some sort of maintenance. Plan for the unplanned!

When you build an emergency savings to three to six months of net pay, you will be able to cover the unexpected expenses and events like losing your job. You will need to work with a budget to understand what three to six months of net pay amounts to.

Savings Are Due

Save for the “emergencies” and the “unplanned maintenance”.

Saving, to me, is the most important item in your budget. Yes, even more important than new clothes!

A good savings account is like having an armed guard on duty to protect your assets from being stolen by “unexpected” visitors that will blow your budget out of the water!

Saving past the level to cover emergencies will help to open the door to new opportunities and potential financial freedom. The extra savings can be used in two ways. First, to provide retirement income. Second, to establish potential income-producing assets.

However, there will not be any extra savings if you do not define your expenses and track them down to get that part of your financial life under control and build a better mindset for your money future!